In Texas, motorists are required to have liability insurance with minimum limits of 30/60/25. This translates to up to $30,000 for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property damage. Of course, some drivers may have higher limits and commercially insured vehicles usually have much higher limits.

Insurance companies are businesses and they want to limit payouts as much as possible. Car insurance companies are notorious for offering low-ball settlements regardless of your injury severity. You should consult with an experienced personal injury attorney if this happens to you.

There are many factors insurance companies consider in a car accident. The obvious one is how severe are the injuries?

A person who has significant trauma due to an accident, like a brain bleed or broken bones, may be awarded the full policy limits available to them. Whereas, a person who suffered minor, soft tissue injuries, like whiplash, may receive a minimal award.

Another factor is the potential for multiple claimants. Once there are more than two claimants involved, it is a race to settle first and the amount potentially available to you begins to diminish significantly. There is only so much of a pie to go around - it is possible for one person to take half before the other claimants get a piece.

We know what you're thinking - simply divide the total amount per accident by the number of claimants to determine how much each person gets - but that is not the rule.

Insurance claims in Texas operate on a first-come, first-served basis. Whichever claimant files and settles their claim first has the potential to receive the most money based on their injuries and medical bills.

One of the best things responsible drivers can do for themselves before they're in a car wreck is to ensure they have the right coverages on their own car insurance policy. Our attorneys recommend that you purchase as much insurance as you can, specifically, Personal Injury Protection (PIP) and Uninsured/Under Insured Motorist Coverage (UM/UIM).

If you are hit by an at-fault driver, you should contact a car accident attorney as soon as possible. An experienced law firm will assess the situation, determine your best course of action, and begin building a winning legal strategy.

Stanley & Associates offers free consultations to all prospective clients. There's truly no cost and no obligation - we want you to know your rights and options. Schedule your free consultation today. Call 844-227-9739

Texas law requires that all motorists have minimum liability policy limits of 30/60/25. This translates to $30,000 for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property damage. Of course, you can purchase a higher liability policy if you desire.

Read more about policy limits and how they affect you.

Liability Insurance helps protect you and your assets from claims or potential lawsuits if you are found to be at-fault for an accident that caused bodily injury or property damage.

If you cause an accident, your passengers and drivers of other vehicles and their passengers can pursue a claim with your insurance company. The insurance company will pay for the medical expenses of the injured party(s) and repair bills for the damaged property. If a lawsuit is filed against you for the accident, your insurance company will provide a lawyer to defend you in litigation.

If you do not have liability insurance, you could be personally liable for the damages you caused to another in addition to fines and legal ramifications imposed by Texas law.

Here are a few things liability insurance does not cover if you are in an accident:

This list does not include every scenario or circumstance.

Many drivers often choose a liability-only policy because they believe additional coverage is too expensive or that additional coverages are unnecessary. Even worse, many drivers do not have insurance at all. With 1 in 5 Texas drivers being uninsured or under insured, you may want to consider the risk and rising costs of medical expenses when reviewing your insurance policy.

It is worthwhile to search for a reputable insurance company that offers additional coverages, such as Personal Injury Protection or Uninsured Motorist, at a low cost. If you already have insurance, ask your insurance agent if there are any deals for adding additional coverage to your existing policy.

Immediately after an accident in which you were injured.

If you are not at-fault and are filing against someone else, you may face resistance or outright denial of your claim - even with a police report or witnesses on your side. Keep in mind, insurance companies are a business and their goal is to minimize the amount they have to pay on insurance claims whether you are their insured or a claimant.

Does your insurance adjuster always seem to be on vacation? Do they underestimate how much pain and suffering you've been through but won't allow you to see a doctor? Is the insurance company making a low-ball offer for your injuries? If this sounds familiar to you, consult with an attorney as soon as possible.

Stanley & Associates understands how frustrating dealing with an insurance company can be. We aim to get the best possible award for your case. Call us today at 844-227-9739.

Being involved in a car accident is a stressful situation. Adding in the possibility that the at-fault driver may not be insured is another issue to add to the whole process.

It isn't fair nor ideal to have to protect yourself from someone else's inability to have insurance, but having Uninsured and Underinsured Motorist Coverage on your own auto policy can help mitigate some of those physical and financial stresses.

To simplify, when you are involved in an accident with an at-fault driver that does not have insurance, you can make an Uninsured Motorist claim with your own insurance to help recoup costs related to your damages.

Under-Insured Motorist Coverage will apply if the at-fault driver did have insurance but did not have enough under their policy limits to cover your damages.

Find out what to do if you were a passenger in an at-fault vehicle.

Auto insurers in Texas are required to offer UM when purchasing an insurance policy OR they must obtain an authorized signature from the policyholder rejecting the coverage. If the insurance company fails to obtain your signed written rejections, you are covered. It is up to you to reject this coverage, not the insurance company. If you are having difficulty filing your injury claim, contact our office right away.

Both refer to subsets of Uninsured Motorist Coverage. UMBI refers to Uninsured Motorist Bodily Injury Coverage. This covers your medical expenses in the event you are injured in a car accident and the at-fault driver was uninsured. UMBI typically covers your passengers for their injuries as well.

UMPD refers to Uninsured Motorist Property Damage Coverage. This covers damage to your car or property after a crash with an at-fault driver who has no car insurance. Pay close attention to this portion of your policy as a payout may be deemed necessary only if the at-fault driver is identified.

A deductible may apply and some UM policies do not include UMPD based on other selected coverages, such as collision coverage.

Remember, the purpose of maintaining liability insurance is to protect yourself and your assets from a potential lawsuit in case you cause an accident. So, if you are hit by someone who does not have liability insurance, that person has opened themselves to fines, penalties, and legal ramifications. You may be able to file a lawsuit against them in pursuit of compensation for your damages.

Keep in mind that very few uninsured drivers have the resources to pay for personal injury damages. You should consult with a personal injury attorney as soon as possible to protect your rights and potential claim.

Review your policy to see if you have Uninsured Motorist (UM) Coverage - this is an incredibly important protection to include on your policy. UM protects you if you’re in an accident with an at-fault driver who doesn’t carry liability insurance - this often includes a hit-and-run situation in which the at-fault driver flees the scene.

If you or a loved one have been injured in a car wreck due to a drunk driver, contact Stanley & Associates for your free case consultation. We have represented thousands of clients across Texas and have over a decade of experience.

Our Texas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

In 2011, a distracted driving violation raised a driver’s car insurance rates by less than 16%, equating to less than $100 per year in extra premiums. In 2020, a cell phone violation can increase your insurance premiums by 21.38%.

Having traffic tickets, moving violations, and other infractions on your driving record can make it difficult to find affordable car insurance. Most drivers know that speeding tickets affect your insurance rates but many don't realize how much of a premium increase to expect.

From 2019 to 2020, the percent increase on your premium for a cellphone violation stayed the same at 22%, the trend leveling out from its upward climb since 2011. But the penalty for distracted driving has increased notably in recent years as insurers learn more about the costs and more states create laws prohibiting it.

In 2020, getting caught texting or otherwise using your phone while driving will raise your insurance rate by an average of 21.65% ($315) — and in some states more than 45.96%. The total cost to your insurance — the rate impact on your policy for three years — for a texting-while-driving violation is $1,772.

Many drivers simply believe they are better than everyone else on the road at multi-tasking while driving but the human brain cannot handle two thinking tasks at the same time. Your brain toggles quickly between multiple tasks but, when driving, this can slow reaction time and cause crashes.

Be safe by silencing your phone, programming your GPS, and setting up your music while you are still parked.

Sources:

https://www.thezebra.com/resources/research/distracted-driving-statistics/

https://www.thezebra.com/auto-insurance/tickets-violations/

https://www.thezebra.com/resources/research/texting-and-driving-statistics/

Glamorized in films like the Fast and the Furious franchise, video games, and other media, street racing at first glance seems exciting and can get adrenaline pumping. During the beginning of the 2020 COVID Pandemic, street racers took advantage of the seemingly quiet streets causing a noticeable increase of illegal street racing and street takeovers.

Street takeovers are noticeably different from street racing, according to one Dallas local named Wikiii. Street takeovers occur when drivers block road access to streets or even major highways to perform slides and donuts on the road or in the middle of intersections amidst spectators. In the drivers' eyes, they are putting on a show. To many residents, government officials, and law enforcement, they are more than just a nuisance - they are a threat to public safety.

On average, 9 out of every 100,000 drivers has received a citation for street racing. Furthermore, nationwide the average number of vehicle-related deaths per 100,000 people in 2017 was 11.4, and the percentage of drivers that had accumulated a prior speeding violation was 11.31%.

Andrew Selsky from AP News reports:

"Jaye Sanford, a 52-year-old mother of two, was driving home in suburban Atlanta on Nov. 21 (2020) when a man in a Dodge Challenger muscle car who was allegedly street racing crashed into her head-on, killing her.

On New Year's Eve (2020) in Mississippi, drivers blocked traffic on an interstate highway in Jackson, the state capital, for an hour while they spun out and did donuts, etching circles in the pavement.

On the night of May 2 (2021), a 28-year-old woman was killed in Phoenix when a street racer crashed into her car. A man was arrested on suspicion of manslaughter.

Police in Albuquerque, New Mexico, handed out thousands of tickets for speeding and racing since a crackdown began in October.

In Denver, police have deployed a helicopter to track races, closed lanes often used by racers and sent officers to places where racers meet. On April 3, a mother was killed when a street racer broadsided her car in downtown Denver.

In one of the most notorious incidents, hundreds of street racers clogged a stretch of interstate in nearby Aurora on March 7 while they raced and cruised. Police warned other motorists to stay away amid reports of guns being brandished and fireworks going off."

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win.

Delaying medical treatment is one of the major arguments used by insurance companies to deny paying a claim or to severely reduce its value. Even if you go to the ER immediately, but do not go to a doctor for a month, that can be a Gap in Treatment (insurance term). The insurance company will say that if you were in pain, you would have seen a doctor immediately. Many times, these gaps are created because you assume the pain will go away, or you think you can’t afford a doctor visit. Our law firm allows clients to treat under a letter of protection. This allows you to get the medical attention you need without paying until the case settles. It is very important to contact us or the doctor if you are not being seen by a doctor and you are still feeling pain.

No medical treatment can severely affect your personal injury case. We are arguing for your pain and suffering. This is separate from your property damage award. The medical records and bills are evidence of your injuries and pain and suffering that are related to the collision. It is extremely important to make sure that you see a doctor if you are feeling any pain that might be related to the accident.

Different insurance companies treat cases differently. We have years of experience with these companies and can take the steps necessary to negotiate your case properly. Remember, the insurance company is representing the driver that hit you. They are NOT ON YOUR SIDE.

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, so you owe us nothing unless and until we win your case.

If you have passengers with you, check on them first. After seeing if everyone is okay, call 911. It is always better to be safe than sorry. Whether the police arrive or not, many insurance policies require that you call 911 to file an accident report. Get the names and phone numbers of witnesses.

Some people only take pictures of their car but taking pictures of everything is even better! Take photos of all cars involved, street lights and signs, the entire scene of the accident, injuries, and license plates. Take pictures of driver's licenses and insurance cards for liability purposes. These photos are a huge plus to have on your side.

You can talk to the police officer, but do not make any kind of statement to the insurance company. Consult with an attorney prior to speaking to the insurance companies. They are building their case against you. It is our job to speak on your behalf and to provide the very best outcome for you. Your job is to focus on recovering from your injuries because your well-being is what matters the most to us.

It is common for whiplash to set in hours or even a day or two after you've just been hit in a car wreck. Bruising can take days or weeks to become apparent. When you've been hit, your body absorbs a lot of trauma - even your brain. Be cautious and get a proper evaluation from a medical professional even if you feel nothing at the time.

Before you go live or do anything else, you need to hire a personal injury attorney. Stanley & Associates will guide you through the process from the moment you've been hit until the very end.

Long story short, get hit, take pics, and go to treatment. Let us deal with the insurance. Like Matthew McConaughey says, everything will be "alright, alright, alright".

The judge and constitutional law professors will tell you about your "civic duty" - to go down to the courthouse for jury duty. To get paid ten dollars a day to take off work and help decide whether or not someone goes to jail, or to decide if someone has to pay.

Just thinking about a trial after a traumatic personal injury can be daunting. That's where our personal injury attorneys can assist you.

Most personal injury cases will settle before a trial. Talk about a weight lifted off your shoulders!

We call a jury to the courtroom and go to trial when an insurance company has refused to pay enough money to settle the case.

In Texas, it is against the law for someone to drive without valid car insurance. During a trial, you cannot mention Allstate, GEICO, or any insurance company - even though they will pay for their insured driver's negligence.

A jury is who will decide which person was negligent in a car wreck. They will also get to decide how much money the injured person will receive as compensation for this process. It can take years to get to trial.

When the final trial date comes, you won’t hear anything about car insurance. It will just be the other driver at court. But their car insurance provided their lawyer and will pay any amount awarded by the jury.

A summons for jury duty is always a surprise and hardly ever fun. But jurors are an integral part of the trial process and the role should not be taken lightly.

Most people shop around to get the cheapest rate on car insurance when looking to switch or insure a new driver. But some DON'T BUY IT AT ALL!!

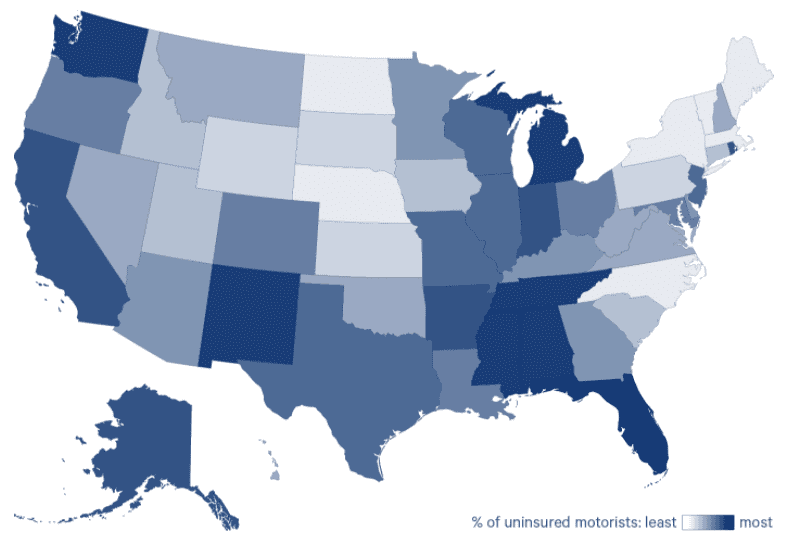

That may surprise you, but according to 2019 data from the Insurance Research Council, it is estimated that 12.6% of motorists across the United States do NOT have insurance. They also further estimated that 8.3% of Texas drivers are uninsured.

Different states have different insurance requirements so it is important that you maintain coverage for your own vehicle at all times. Florida has the highest rate of uninsured motorists with an estimated rate of 26.7%! Not only that, residents of Florida are not required to have bodily injury liability. This means if you're hit by a Florida motorist, your odds of them being insured are less than 1 in 4. Even worse, the chances of compensation for your injuries are even slimmer. Not cool, Florida.

When someone calls our office after they've been hit by an Uninsured driver, most of the time, the person who hit them didn't even get a ticket for being uninsured. We often ask our clients if they have Uninsured Motorist Coverage, commonly referred to as UIM, and they reply that they have "Full Coverage". However, this type of coverage often refers to Collision which will only cover damages to your vehicle - not your injuries.

Uninsured Motorist (UIM) and Underinsured Motorist (UM) coverage will cover your bodily injuries when you're hit by someone without insurance or someone without enough insurance. These are two separate types of coverage that are typically bundled together. Many motorists choose not to include these coverages due to financial concerns. We ask that you consider the financial implications of being seriously injured by someone without insurance.

Most people buy car insurance and then forget the coverage they have. The last thing you want to do is suffer through your injuries if you've been hit by an uninsured or underinsured driver. Take a minute today to review your coverage to see if you're protected if you get hit by an uninsured driver.