In 2011, a distracted driving violation raised a driver’s car insurance rates by less than 16%, equating to less than $100 per year in extra premiums. In 2020, a cell phone violation can increase your insurance premiums by 21.38%.

Having traffic tickets, moving violations, and other infractions on your driving record can make it difficult to find affordable car insurance. Most drivers know that speeding tickets affect your insurance rates but many don't realize how much of a premium increase to expect.

From 2019 to 2020, the percent increase on your premium for a cellphone violation stayed the same at 22%, the trend leveling out from its upward climb since 2011. But the penalty for distracted driving has increased notably in recent years as insurers learn more about the costs and more states create laws prohibiting it.

In 2020, getting caught texting or otherwise using your phone while driving will raise your insurance rate by an average of 21.65% ($315) — and in some states more than 45.96%. The total cost to your insurance — the rate impact on your policy for three years — for a texting-while-driving violation is $1,772.

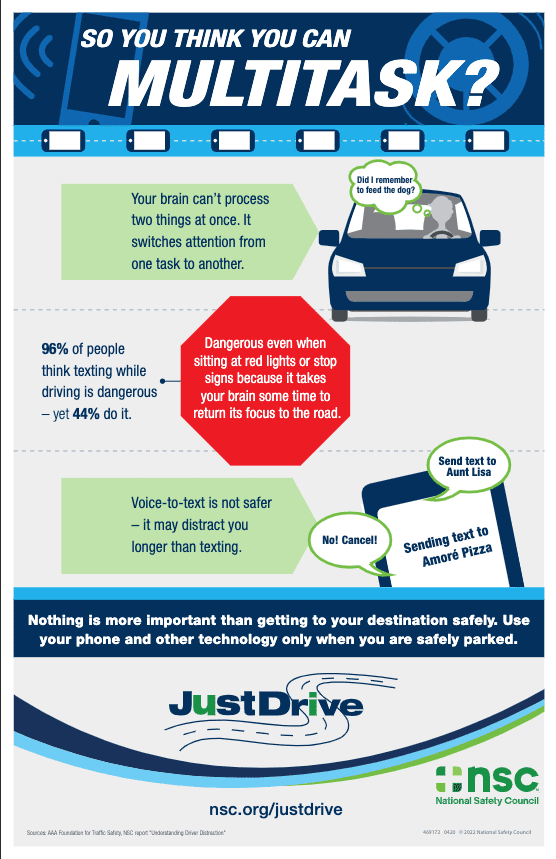

Many drivers simply believe they are better than everyone else on the road at multi-tasking while driving but the human brain cannot handle two thinking tasks at the same time. Your brain toggles quickly between multiple tasks but, when driving, this can slow reaction time and cause crashes.

Be safe by silencing your phone, programming your GPS, and setting up your music while you are still parked.

Sources:

https://www.thezebra.com/resources/research/distracted-driving-statistics/

https://www.thezebra.com/auto-insurance/tickets-violations/

https://www.thezebra.com/resources/research/texting-and-driving-statistics/

While the percentage of drivers using handheld devices has decreased in recent years, many experts feel the use of distracting devices is significantly undercounted.

Fact is, drivers frequently lose focus of the road. Their eyes drift and their minds wander as they connect on cell phones or other technologies built into vehicle dashboards.

So, let’s now talk about “inattention blindness,” defined as the failure to notice a visible hazard because your attention is focused elsewhere. This phenomenon occurs regularly when drivers are cognitively distracted.

Research shows just listening to a cell phone conversation decreases brain activity associated with driving by more than one-third, leading to safety performance issues, such as the inability to react quickly in congested driving zones.

Think of it as driving blindfolded. Who drives like that?

Of course, using electronics is not the only way drivers can be distracted. Talking or texting on the phone, eating or drinking, applying makeup or shaving, reading a newspaper or book, watching a video, or programming a GPS are all examples of the following distraction categories: visual, manual (taking a hand off the wheel) or cognitive (taking your mind off driving).

All can raise safety risks, not only for drivers but also for those sharing the road around them. Hands-free devices may be marginally safer than handheld ones, but the safest choice of all is not using your cell phone or other technology while you are driving.

Your brain toggles quickly between these two tasks. When driving, this can slow reaction time and cause crashes. Be safe by silencing your phone, programming your GPS and setting up your radio or music while you still are parked.

Your life is much more valuable than any phone call, text or playlist.

Sources:

nsc.org/justdrive

https://newsroom.aaa.com/2017/10/new-vehicle-infotainment-systems-create-increased-distractions-behind-wheel

https://injuryfacts.nsc.org/motor-vehicle/motor-vehicle-safety-issues/distracted-driving

https://www.cmu.edu/news/archive/2008/March/march5_drivingwhilelistening.shtml

Hands-free is not risk free.

The science is crystal clear on this fact and numerous studies have demonstrated that the use of handheld and hands-free devices while driving pose a significant safety risk to motorists, their passengers and others on the road.

Hands-free devices and voice command systems create a cognitive distraction as the driver mentally engages with interactive tasks.

While hands-free options may be marginally safer than handheld devices, eliminating driver use of all types of cell phones and in-vehicle infotainment systems is safest.

Drivers think cell phone use is distracting … for other people

Although 87% of people think talking on a cell phone while driving is a serious safety threat, 49% have talked on a handheld phone while driving. Drivers should talk the talk AND walk the walk, refraining from using their phone when behind the wheel.

It is impossible to multitask and give equal attention to each task

People often think they are effectively accomplishing two tasks at the same time. It is possible to complete a phone conversation while driving and arrive at the destination without incident, but it is a misconception that the tasks can be done simultaneously and as safely as possible. Motorists should make driving the primary focus and perform other cognitively demanding tasks only when safely parked.

Source: nsc.org/justdrive

That is 21 years of daily deaths on our roadways with more than 75,000 lives lost to preventable, fatal crashes. More than 4,480 people were killed on Texas roads in 2021, making it the second deadliest year since TxDOT began tracking fatalities in 1940. Sadly, 1981 was the deadliest year with 4,701 fatalities.

The increase in fatalities in Texas last year reflects a deadly trend nationwide. An estimated 20,160 people died in motor vehicle crashes in the first half of 2021, up 18.4% over 2020. In Texas, traffic fatalities were up 15 percent from 2020-2021.

Changing driver behavior is one of the most important solutions. In 2020, nearly one in five crashes on Texas roads were caused by a distracted driver. In 2021, a total of 1,522 people were killed because of speed, and a total of 1,219 people were killed because they were not wearing a seat belt. These distractions and decisions could have easily been prevented and 2,741 lives could have been saved.

East Texas, in particular - the Atlanta District, is seeing a steady increase in fatal crashes. That district also led the state in the number of roadway deaths per vehicle miles traveled in 2020. The TxDOT Atlanta District covers Bowie, Cass, Camp, Harrison, Marion, Morris, Panola, Titus, and Upshur Counties. Officials say speed is one of the top reasons for the increase.

"Drivers are running red lights, they’re driving way too fast on roads that cannot accommodate those speeds, and drivers are distracted and not wearing seat belts,” Wells said. “Drivers need to make paying attention, buckling up, and slowing down a habit. This is something they can do every day to ensure that everyone gets home safely.”

TxDOT launched a campaign called #EndTheStreakTX in hopes that daily fatal crashes in the state will end. The campaign offers these tips to prevent distracted driving that can protect drivers on the road:

If you or a loved one have been injured in a car wreck due to a drunk driver, contact Stanley & Associates for your free case consultation. We have represented thousands of clients across Texas and have over a decade of experience.

Our Texas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

“Traffic crashes are the leading cause of death for teen drivers and knowing that a whopping majority of teens admit to driving distracted is very scary,” says Marie Dodds, AAA Oregon/Idaho Director of Government and Public Affairs. Texting while driving is among the riskiest of common driving distractions. Teen drivers are still developing safe driving skills and should limit unnecessary risks.

Texting while driving is among the riskiest of common driving distractions. Despite texting bans in 48 states, smartphone use behind the wheel is a common problem. Research released by the AAA Foundation for Traffic Safety finds that even though 96 percent of drivers say texting/emailing while driving is a serious or very serious threat to their safety, 39 percent admit to having read a text or email, and 29 percent admit to typing one.

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

Back in 2010, Congress passed a resolution to create a special month devoted to increasing awareness of the dangers of distracted driving. According to a survey conducted by National Occupant Protection Use Survey, approximately 660,000 drivers are using cell phones or manipulating electronic devices at any given moment.

"Distracted driving is a serious and deadly epidemic on America’s roadways,” said U.S. Transportation Secretary Ray LaHood. “There is no way to text and drive safely. Powering down your cell phone when you’re behind the wheel can save lives – maybe even your own.”Being an attentive and alert driver can help prevent crashes that lead to unintentional injury and death.

With the rapid adoption of smartphones in the United States, distracted driving has become a hot topic in traffic safety. While cell phones and navigation devices often are the culprit when it comes to distracted driving, conventional distractions such as interacting with passengers and eating also contribute to crashes. Distracting tasks can affect drivers in different ways and can be categorized as visual, manual, and cognitive distraction.

Make no mistake, multitasking technology is about convenience - not safety. Ending distracted driving is everyone's responsibility.

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

Glamorized in films like the Fast and the Furious franchise, video games, and other media, street racing at first glance seems exciting and can get adrenaline pumping. During the beginning of the 2020 COVID Pandemic, street racers took advantage of the seemingly quiet streets causing a noticeable increase of illegal street racing and street takeovers.

Street takeovers are noticeably different from street racing, according to one Dallas local named Wikiii. Street takeovers occur when drivers block road access to streets or even major highways to perform slides and donuts on the road or in the middle of intersections amidst spectators. In the drivers' eyes, they are putting on a show. To many residents, government officials, and law enforcement, they are more than just a nuisance - they are a threat to public safety.

On average, 9 out of every 100,000 drivers has received a citation for street racing. Furthermore, nationwide the average number of vehicle-related deaths per 100,000 people in 2017 was 11.4, and the percentage of drivers that had accumulated a prior speeding violation was 11.31%.

Andrew Selsky from AP News reports:

"Jaye Sanford, a 52-year-old mother of two, was driving home in suburban Atlanta on Nov. 21 (2020) when a man in a Dodge Challenger muscle car who was allegedly street racing crashed into her head-on, killing her.

On New Year's Eve (2020) in Mississippi, drivers blocked traffic on an interstate highway in Jackson, the state capital, for an hour while they spun out and did donuts, etching circles in the pavement.

On the night of May 2 (2021), a 28-year-old woman was killed in Phoenix when a street racer crashed into her car. A man was arrested on suspicion of manslaughter.

Police in Albuquerque, New Mexico, handed out thousands of tickets for speeding and racing since a crackdown began in October.

In Denver, police have deployed a helicopter to track races, closed lanes often used by racers and sent officers to places where racers meet. On April 3, a mother was killed when a street racer broadsided her car in downtown Denver.

In one of the most notorious incidents, hundreds of street racers clogged a stretch of interstate in nearby Aurora on March 7 while they raced and cruised. Police warned other motorists to stay away amid reports of guns being brandished and fireworks going off."

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win.

(CNN) - Nine people -- including six student athletes and their coach -- were killed in a fiery crash between a pickup truck and a van carrying members of the University of the Southwest's men's and women's golf teams, officials said Wednesday.

The crash happened around 8:17 p.m. Tuesday just outside Andrews, Texas, the Texas Department of Public Safety said."A Dodge 2500 pickup was traveling southbound on FM 1788. A Ford Transit passenger van registered to the University of the Southwest in Hobbs, NM was traveling northbound on FM 1788," the DPS said in a statement. An earlier notice from the agency misidentified the pickup as a Ford F-150.

"For unknown reasons, the Dodge pickup drove into the northbound lane and struck the Ford passenger van head on," DPS Sgt. Steven Blanco said. "Both vehicles caught fire and burned."

Six students and one faculty member aboard the university van were killed, the DPS said. The driver and a passenger in the pickup truck also died.

If you need a wrongful death attorney in Texas, call Stanley & Associates

Many times when a death of a loved one occurs due to the negligence of another, a civil lawsuit is not the first thing on your mind. However, it is very important that a tough, experienced, and compassionate attorney gets involved at the start of the case. Evidence needs to be protected and circumstances need to be figured out.

Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call Stanley Associates at 844-227-9739

Delaying medical treatment is one of the major arguments used by insurance companies to deny paying a claim or to severely reduce its value. Even if you go to the ER immediately, but do not go to a doctor for a month, that can be a Gap in Treatment (insurance term). The insurance company will say that if you were in pain, you would have seen a doctor immediately. Many times, these gaps are created because you assume the pain will go away, or you think you can’t afford a doctor visit. Our law firm allows clients to treat under a letter of protection. This allows you to get the medical attention you need without paying until the case settles. It is very important to contact us or the doctor if you are not being seen by a doctor and you are still feeling pain.

No medical treatment can severely affect your personal injury case. We are arguing for your pain and suffering. This is separate from your property damage award. The medical records and bills are evidence of your injuries and pain and suffering that are related to the collision. It is extremely important to make sure that you see a doctor if you are feeling any pain that might be related to the accident.

Different insurance companies treat cases differently. We have years of experience with these companies and can take the steps necessary to negotiate your case properly. Remember, the insurance company is representing the driver that hit you. They are NOT ON YOUR SIDE.

If you have been injured in an auto accident in or around Dallas, contact Stanley & Associates for your free case consultation. Stanley & Associates has represented clients across Texas and throughout the United States for over ten years. Our firm has successfully won thousands of cases during this time.

Our Dallas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, so you owe us nothing unless and until we win your case.

If you have passengers with you, check on them first. After seeing if everyone is okay, call 911. It is always better to be safe than sorry. Whether the police arrive or not, many insurance policies require that you call 911 to file an accident report. Get the names and phone numbers of witnesses.

Some people only take pictures of their car but taking pictures of everything is even better! Take photos of all cars involved, street lights and signs, the entire scene of the accident, injuries, and license plates. Take pictures of driver's licenses and insurance cards for liability purposes. These photos are a huge plus to have on your side.

You can talk to the police officer, but do not make any kind of statement to the insurance company. Consult with an attorney prior to speaking to the insurance companies. They are building their case against you. It is our job to speak on your behalf and to provide the very best outcome for you. Your job is to focus on recovering from your injuries because your well-being is what matters the most to us.

It is common for whiplash to set in hours or even a day or two after you've just been hit in a car wreck. Bruising can take days or weeks to become apparent. When you've been hit, your body absorbs a lot of trauma - even your brain. Be cautious and get a proper evaluation from a medical professional even if you feel nothing at the time.

Before you go live or do anything else, you need to hire a personal injury attorney. Stanley & Associates will guide you through the process from the moment you've been hit until the very end.

Long story short, get hit, take pics, and go to treatment. Let us deal with the insurance. Like Matthew McConaughey says, everything will be "alright, alright, alright".